Let’s be real—managing money as a family is like playing with burning torches. With rent, groceries, surprise school field trips, and random repairs, it’s a miracle the budget goes down in flames before the month does.

But the secret is: you don’t need to become a cash guru or build a spreadsheet empire to make it work. A few small tweaks can do it. These home budgeting tips are easy to apply, within your reach, and yes—real people like you do it on a daily basis.

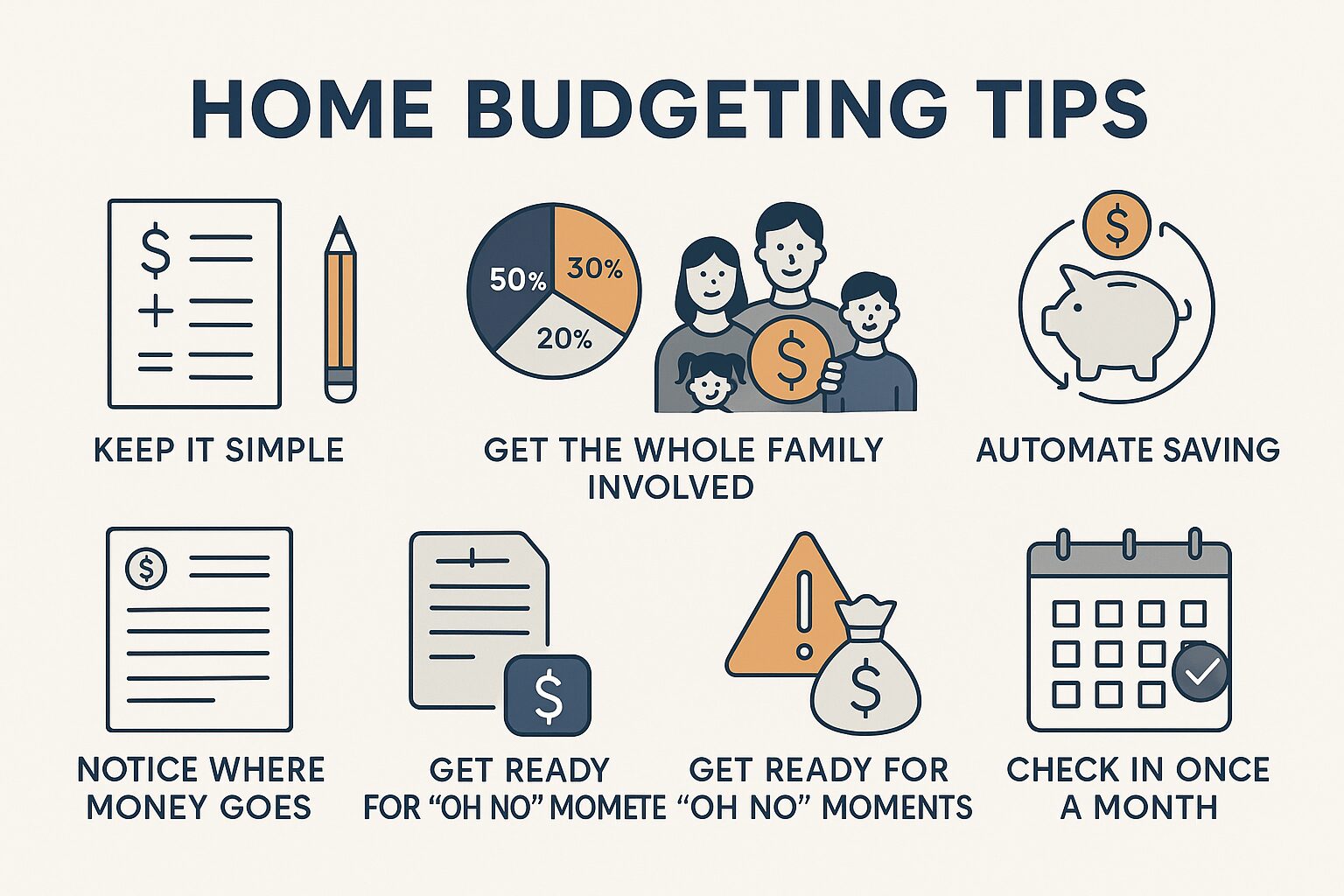

1. Keep It Simple (Seriously)

You don’t need to shell out five pieces of budgeting software or some kind of gosh-awful color-coded spreadsheet. Just jot it down on a piece of paper or blank spreadsheet. The idea is to be cognizant of:

- What you’re making

- What you’re spending

- How much you’d like to save

That’s it. Don’t complicate it. Follow and increment.

2. Use the 50/30/20 Rule (Or Something Close)

Most households find the following helpful:

- 50% for the necessities (rent, groceries, bills)

- 30% for the want-to-haves (eating out, hobbies, streaming)

- 20% for saving or debt repayment

It’s not a recipe. If your rent is over 50%, no problem—just redo. It’s about finding a balance, not being perfect.

3. Get the Whole Family Involved

Money talks don’t have to be formal. Keep it casual and include all:

- Talk about goals (vacation fund, fix the roof)

- Involve older kids in price comparisons when you shop or cook a budget meal

- Turn saving into a game—like a “no-spend” week where you try to make it through as many days of the week as you can without spending a cent

Once you’ve got everyone on board with the plan, it’s less hard to stick with it.

4. Automate Auto-Saving (and Forget It)

Save as you brush your teeth—better yet, make it automatic. Establish an automatic transfer of funds from checking into savings upon receipt of your paycheck. Have a start with $25 or $50 per month if this is the best you can do. It’s consistency, not perfection, that matters.

5. Notice Where Money Goes

You don’t need to keep tabs on every single coffee cup. But it does serve you well to take a glance at your bank statement every week.

Notice trends, like:

- More restaurant meals than you even realized

- Overlooked subscriptions

- Spur-of-the-moment buys that snuck up on you

No shame—just pay attention. That alone will give you the traction to make healthier decisions next month.

6. Get Ready for Life’s “Oh No” Moments

You know they’re coming—a flat tire, a surprise bill, or your kid’s soccer shoes suddenly falling apart.

An emergency fund is your buffer. Try to build it up to cover 1–3 months of expenses. But even starting with $500 is a win. Keep it in a separate account so you’re not tempted to dip into it.

7. Check In Once a Month

Budgets never exist. Life gets in the way, and your plan will have to change.

Carve out

Learn more

If you’re looking for more practical ways to stretch your family budget, check out our guide on Finance section . And if you want a simple, printable worksheet to help you get started, the Consumer.gov Budget Worksheet is a great free resource.