Cryptocurrency has gone from a niche internet experiment to a mainstream financial force that dominates headlines, YouTube debates, podcasts, and even family dinners. Everyone seems to have an opinion on it—some call it the future of money, others dismiss it as a dangerous bubble.

The real question is: should you invest in crypto?

The answer isn’t as simple as yes or no, because crypto isn’t like buying traditional shares or opening a savings account. It’s a whole new category with unique opportunities—and risks—that demand a closer look. If you’ve been on the fence, this deep dive will give you both sides of the story, so you can decide if crypto belongs in your portfolio.

What Exactly Is Crypto?

Before deciding whether to invest, you need to clear away the hype and understand the basics. At its core, cryptocurrency is a type of digital money that doesn’t rely on banks or governments. Bitcoin, the original cryptocurrency, was launched in 2009 as a decentralized alternative to traditional finance.

Instead of payments being verified by a central authority, crypto uses a blockchain, which is essentially a distributed ledger where transactions are recorded permanently and transparently.

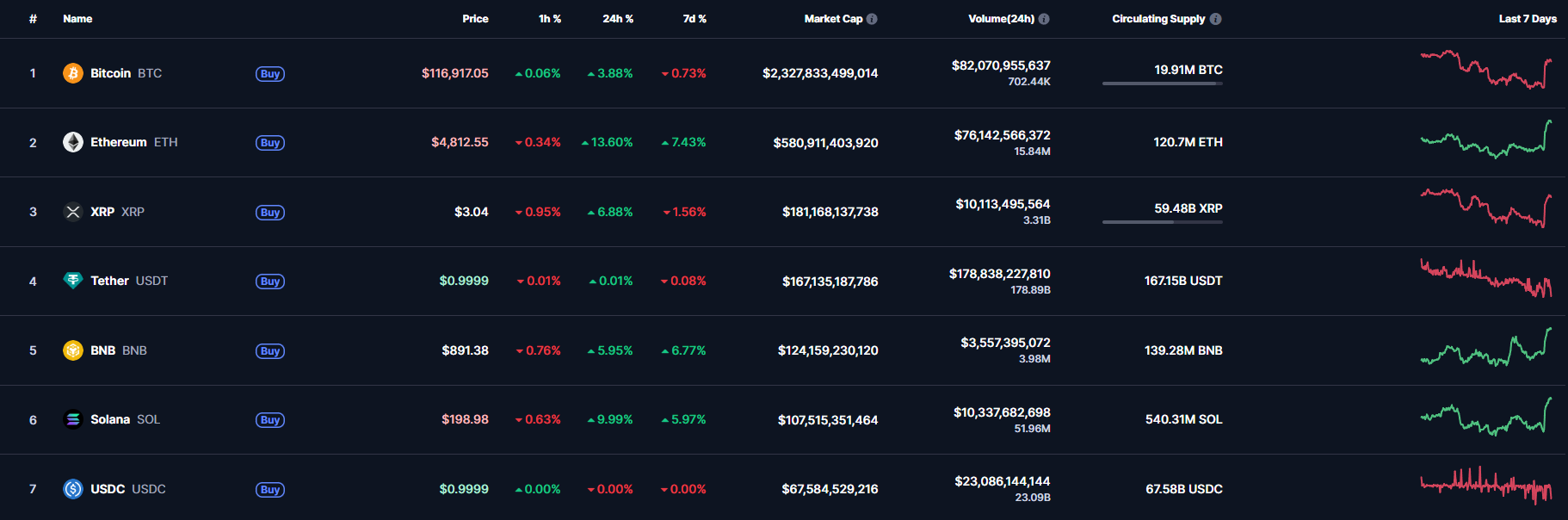

Today, there are thousands of different cryptocurrencies. Some, like Ethereum, focus on powering smart contracts and decentralized apps. Others, like Solana or Polygon, try to make blockchain faster and cheaper. And then there are meme-inspired tokens like Dogecoin, which started as a joke but evolved into a multi-billion-dollar asset.

The Case for Investing

Supporters argue that crypto is not only an exciting new technology but also a generational opportunity. Here are the main reasons proponents invest:

1. Huge Growth Potential

When Bitcoin first appeared, you could buy it for a few cents. In 2021, it hit an all-time high near $69,000. Even after sharp corrections, it remains one of the best-performing asset classes of the last decade. Some analysts compare investing today to buying internet stocks in the mid-90s—volatile, but with enormous upside if you pick the right winners.

2. Hedge Against Inflation

Unlike traditional currencies that can be printed endlessly by central banks, Bitcoin has a hard cap of 21 million coins. This scarcity makes it attractive to those worried about inflation and the declining value of cash. Investors sometimes call it digital gold.

3. 24/7 Global Market

The stock market closes at 4 p.m. and sleeps on weekends. Crypto never does. It trades 24/7 globally, meaning opportunities can emerge (and vanish) anytime. For some investors, this accessibility is exciting.

4. The Rise of Web3 and Innovation

Crypto isn’t only about money—it’s fuel for entire new industries. Decentralized finance (DeFi) platforms let people earn yields or borrow without banks. Non-fungible tokens (NFTs) have opened paths for artists to monetize digitally. Ethereum and similar platforms serve as operating systems for this emerging decentralized internet.

The Case Against Investing

With every opportunity comes risk, and crypto has plenty of it. Ignoring these would leave you unprepared.

1. Extreme Volatility

Cryptocurrency prices can double in a week—and crash just as fast. Bitcoin has suffered multiple drawdowns of over 70% since its creation. If you’re used to the relative stability of blue-chip stocks or real estate, crypto’s rollercoaster may not be for you.

2. Regulation Uncertainty

Governments are still figuring out how to regulate digital assets. The U.S. has ongoing debates about whether cryptocurrencies are securities or commodities. Some countries ban crypto outright. One unexpected law could drastically reshape the industry.

3. Scams and Security Issues

While blockchain technology itself is resilient, the surrounding ecosystem isn’t always safe. From exchange hacks to Ponzi schemes, billions have been lost to security breaches and scams. Unlike your bank account, stolen crypto is rarely recoverable.

4. No Intrinsic Value

Skeptics argue that cryptocurrencies lack intrinsic value. A share of Apple represents ownership in a company that generates profits. A bond promises future debt repayments. A Bitcoin doesn’t generate cash flow—its value relies on what someone else is willing to pay.

Should You Invest? The Balanced View

So, where does that leave you? Like most things in finance, the answer depends on your situation, goals, and risk tolerance.

If you’re curious but cautious, crypto should probably not be your entire portfolio—it should be a small speculative piece of it. Some investors allocate 1–5% of their wealth to crypto, just in case it truly becomes “the next big thing.”

That way, if crypto skyrockets, you benefit, but if it collapses, you won’t lose your financial security.

Smart Ways to Enter the Market

If you do decide to dip your toes in, there are several ways to approach investing responsibly.

1. Start Small

Only put in money you can afford to lose. Think of it like buying a lottery ticket—fun, with potential, but not crucial to your future stability.

2. Use Reputable Exchanges

Stick to large, regulated exchanges when buying. Platforms like Coinbase, Binance, or Kraken are considered safer than back-alley apps promising sky-high returns.

3. Educate Yourself Constantly

Crypto evolves daily. Read trusted sources such as CoinDesk or CoinTelegraph. Watch how markets respond to regulation news. Understanding narratives will help you navigate better.

4. Consider Long-Term Holding (“HODLing”)

Unless you’re an experienced trader, trying to time crypto markets often leads to frustration. Many successful investors buy a small amount and simply hold for years, ignoring short-term noise.

5. Explore Beyond Coins

Crypto is more than tokens—there are platforms for lending, decentralized finance, and staking. Once comfortable, you can explore these avenues carefully.

Who Should Probably Avoid Crypto

Despite all the excitement, crypto is not for everyone. If you:

-

Can’t handle stress from volatility

-

Rely on every cent of your savings

-

Expect steady retirement-style returns

…it’s better to focus on traditional investments. Stocks, bonds, ETFs, and even real estate offer growth without the daily headache of 30% swings.

The Future Outlook

Crypto isn’t going away anytime soon. In fact, major banks, hedge funds, and governments are now involved. Companies like Tesla and Square have invested in Bitcoin. Even PayPal allows crypto payments.

The question isn’t if crypto will stick around—it already has. The real question is what role it will play in everyday finance. Will it truly replace parts of the banking system, or will it remain a speculative asset class held by enthusiasts?

Nobody knows for sure, and that uncertainty itself is what makes this such a captivating space.

Final Thoughts

Investing in cryptocurrency is neither a guaranteed ticket to riches nor an automatic financial disaster. It’s something in between—a rapidly evolving asset class that rewards those who learn, stay cautious, and manage risk.

Ask yourself: Am I comfortable with losing what I put in? Am I excited enough by the potential to accept the swings? Do I see this as a long-term experiment, rather than a quick win?

If the answer is yes, then a small, measured investment could give you exposure to one of the most fascinating financial stories of our time.

If the answer is no, that’s fine too—there are plenty of other ways to build wealth without enduring the midnight adrenaline rushes of crypto charts.

Either way, crypto has succeeded in sparking one of the most important discussions about money in a generation. And whether you invest or not, simply understanding it makes you more prepared for the future of finance.